There are many things going on in our industry in 2018 that are going to start raising the price you pay for repairs or replacement. The governments restrictions on R22 (FREON) are choking down the supply even more this year causing the prices to rise on refrigerant, and then the new tariffs that are going to be put on chinese steel and aluminum, we can expect that equipment prices are going to be going up. Now more than ever it is a great idea to make sure you are getting your HVAC equipment serviced twice a year (for the typical home). Baptist Heating & Air can help with that, as we have service agreements priced at $180 that will cover your single system for 1 year! We are getting ready to have our last snow, after that, when the temperature is just over 65, give us a call, and we will get your system running back to manufacturers specifications.

Archive for the ‘Uncategorized’ Category

Plasma Generators

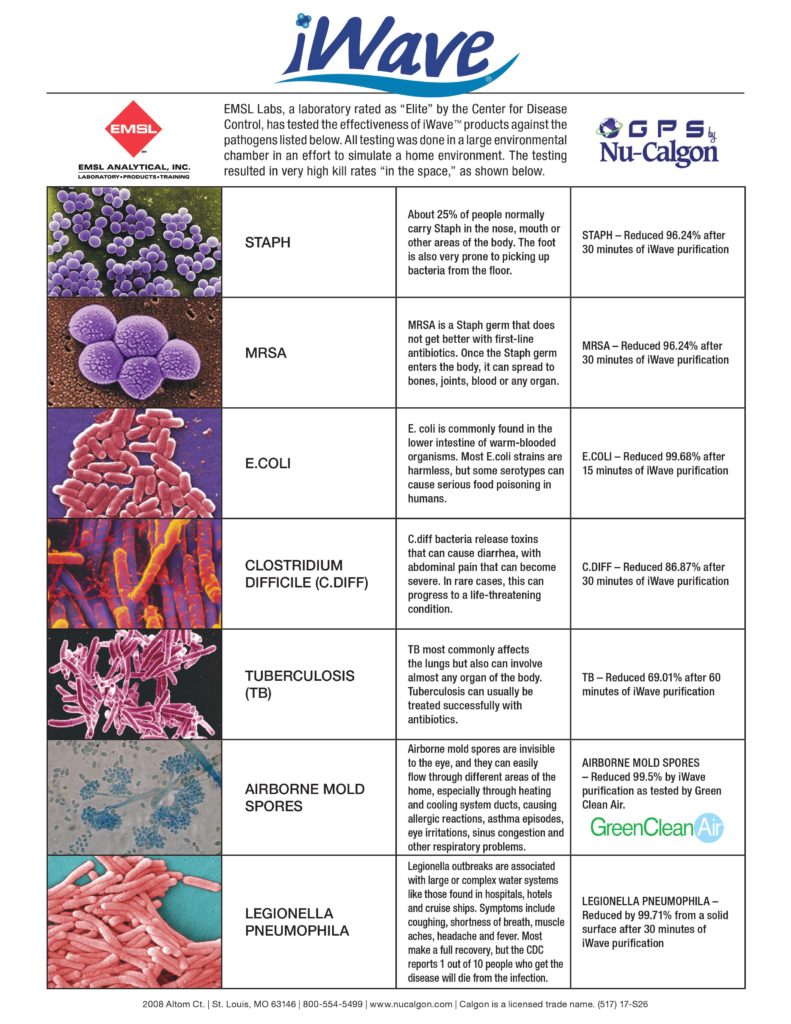

Baptist Heating has installed quite a few plasma generators.

Plasma in it’s simplest form is oppositely charged hydrogen & oxygen ions, also called bipolar ionization. These naturally occurring ions are artificially produced when a the plasma generator produces a high voltage. The plasma is then injected into the HVAC air stream where it breaks down gases to harmless compounds such as oxygen, nitrogen, water vapor and carbon dioxide. In addition to the reduction of gases and odors, plasma also reduces particulates and kills mold, bacteria and virus because an ion cluster is formed around the particle which increases the size, and that allows your air filter to grab it out of the air!

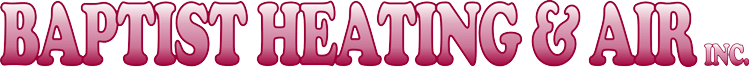

Yes, we are told that Plasma Kills Virus, Bacteria and Mold

Positive and negative ions surround the pathogen. Next, the ions rob the pathogens of the hydrogen necessary for them to survive. During the final step, the ions eliminate hydrogen from the pathogen and then the cleansing process is complete, making the airborne virus, bacteria or mold spore inactive.

Great device to pair with an Accuclean

When a plasma generator is coupled with a great air cleaner, like the Accuclean even healthier air is produced!

Accuclean Air Cleaners

Our Accuclean Air cleaners are the best in the industry.

- Removes Over 99% Of The Common Flu, Or Influenza A Virus, From The Filtered Air In Your Home

- Catches Particles Even Smaller Than .1 Micron In Size

- 8 X More Effective Than The Best HEPA Room Appliance you can buy

- 100 Times More Effective Than A Standard 1″ Throwaway Filter Or Ionic-Type Room Appliance

- Delivers the Most Clean Air with the Highest CADR in the Industry

- Reusable Filter Is Easy To Vacuum Or Wash

It is getting extremely Cold tonight!

Important Notice from: Baptist Heating & Air Inc.

Tuesday night through Thursday we will have temperatures that will be below the design temperatures of your HVAC System in Indianapolis and surrounding areas. The design temperature for our area is 5 degrees. So anytime the temperatures drop below 10 degrees there can be problems heating. This artic blast could possibly drop the temperature in your home to lower than what you have your setpoint set at. These low outdoor temps will cause newer homes to struggle to maintain temperature and older homes likely will NOT maintain temperature at your setpoint. Which means the temperature in your home may drop while the heating system is still functioning correctly and working at full capacity.

1. Please raise the temperature in your home on Tuesday 2 to 4 degrees above your normal setting.

2. Take all programmable thermostats out of setback mode and set on a permanent HOLD.

3. Replace the filter(s) on your furnace or air handler.

4. Keep garage doors closed.

5. Limit opening any exterior doors.

6. Make sure all air vents are not blocked or obstructed.

7. If you have a 90%+ furnace, you must keep the PVC intake &exhaust clear of ice build up.

If the temperatures drop in your home, it will not be able to recover until temperatures.

To help minimize temperature loss you can boil water, make soup or stews; they help introduce humidity and warmer temperatures into your home. You can even make cookies! But do not use your oven or a grill to heat your home. Please check on neighbors and elderly residents during these extreme temperatures. Stay warm and safe this week and share this with any of your family and friends.

The key is do NOT panic with falling temps inside your home if you have heat coming out of your registers. It is probably doing all that it can.

If you need us, or have a question give us a call at Baptist Heating & Air, Inc. at 317-782-1900

Stay safe and make sure to bring your pets inside!

My house is too cold!

Questions and Answers for when it gets REALLY, REALLY COLD!

Is it normal for my house temperature to drop when temperatures outside drop below 5 degrees Fahrenheit in Indianapolis, Indiana and surrounding areas like Fishers, Carmel, Geist, Zionsville, and Plainfield?

Yes, when the temperatures outside drop below what we call the “outdoor design temperature“, it is possible and actually likely if the low temperatures continue. HVAC contractors typically design systems to maintain your home at 69 degrees, called “indoor design temperature“, which is what is recommended by ACCA(which is the Air Conditioning Contractors of America). So, when we have temperatures below 0 degrees Fahrenheit here in Indy, yes, your home can “lose ground”

Is there anything that can be done before the temperature inside has dropped?

Yes, whenever you know an arctic cold blast is on its way or that temperatures are going to drop you can usually raise your temperature above the 69 degrees so that you have some extra degrees to “lose”. You can also:

1. Check your air filter, time slips by quickly, & it is THE MOST COMMON PROBLEM WITH HVAC

2. Make sure to get your HVAC system serviced yearly by Baptist Heating & Air Inc.

3. Observe your system to notice changes in noises & sounds & pay attention to sights and “feels”

Is there anything else that can be done after the cold hits?

When the temperatures drop below the design temperature and stay under, if you have “lost ground” so that you are below the temperature you are comfortable with you can try to heat up the house other ways:

1. Turning all the lights on in the house will help, especially if you have old incandescent bulbs, and not LED’s & compact fluorescents.

2. Run your oven through a cleaning cycle, or make cookies!

3. Some TV’s will help heat up the home as well

4. Cook some bacon(I had to squeeze that in)Stay warm! I hope this helps you out.

If you have any other questions, dont hesitate to give us a call, we will be happy to help you out!

Rob

November 2016 Good News Food Drive

Baptist Heating & Air is teaming up with Mcgreggor Road Baptist Church to collect food for Good News Mission from now until November 20th.

Carrier & Bryant won’t be Made in the U.S.A.

Carrier & Bryant won’t be Made in the U.S.A.

With the recent announcement that Carrier & Bryant won’t be Made in the U.S.A. because they are moving their manufacturing from Indianapolis, Indiana to Mexico over the next few years, everyone seems to have an opinion from the man on the street, all the way up to Donald Trump. We are saddened that production of our major competitor is going to leave our country, even, our state. As an American I think honest competition is a necessary element for capitalism. As either a Democrat, or Republican it is sad for all of us to see jobs go south, and we all prefer products made in the U.S.A., Right? Now a big vacuum of jobs will take place in our city, with many people losing their jobs. We will be praying for the local families that will be affected.

Most HVAC manufacturers in the last 10 years have moved some or all of their production to Mexico, and have started sourcing parts from all over the world. Rheem / Ruud has for example been slowly moving production from Fort Smith, Arkansas to Nuevo Laredo, Mexico, with all of their air conditioner and heat pump production now gone. All this makes you think Ross Perot was right when he talked about a “sucking sound” taking all of our jobs away.

Baptist Heating & Air Inc & American Standard

At Baptist Heating & Air, we have always been very concerned about where our products have been made. In the early 2000’s we sold Goodman products which at the time had the longest parts warranties, was the worlds largest privately held HVAC manufacturer, and their products were made in Tennessee and Texas. However, that changed when they decided to go public with their stock, and the first change that we noticed, was the removal of domestic parts, then the quality of them at Amana went down. Now at this stage, I believe that every HVAC manufacturer has some “international” parts inside their products. At this stage, the best contractors and consumers can hope for is that the products have very few international parts, and high quality control over all parts. These are the things that drove us to sell American Standard, so in 2012 we completely switched over to the best brand. These days American Standard has 10 year parts warranties on their products, they still assemble in the U.S.A., and we still make most of our parts! American Standard engineers are still making innovations, while most of the other brands have been struggling the last few years with the “big secret” about Copeland Compressor sludge problems(due to outsourcing), we have enjoyed the same trouble free compressors that we have made in-house, since American Standard and Trane are the only companies that still make our own compressors. No company is perfect, but I’m glad that our product is still Made in America. Here are a few documents from 2012 showing models of our American Standard Condensers, Heat Pumps, Air Handlers, furnaces, roof top units, and furnaces that are made in the U.S.A. Additionally, we have over 50 other products that we procure specifically because they are made in America. If you would like more information don’t hesitate to give us a call. 317-782-1900.

We are sad that Carrier & Bryant won’t be Made in the U.S.A.

Tax Credits are back!

Tax Credits are back!

You may qualify for these credits even if you installed your furnace years ago. We will be calling our customers in the next few weeks to let you know if the furnace you already installed qualifies for the credit. Furthermore, most of the furnaces we sell qualify for the credit also. Please don’t hesitate to give us a call, we will take care of you. Details about the IRS tax credit are below:

WHAT IS A FEDERAL ENERGY TAX CREDIT?

TAX PAYER RELIEF ACT OF 2012

As part of the recently passed American Tax Payer Relief Act of 2012, Congress modified and extended its energy efficiency tax credits for appliances, new homes and retrofits to existing homes, which includes the 25C heating and cooling equipment tax incentive for 2012 through 2016. Thanks to the federal legislation retroactively extending previously available tax credits, homeowners may be eligible for a tax credit if they purchase certain types of heating, ventilation and air conditioning (HVAC) systems, water heating equipment, or make other energy-related improvements to their homes between January 1, 2012 and December 31, 2016. The new legislation extends the cumulative cap of a $500* maximum tax credit.

ENERGY IMPROVEMENT AND EXTENSION ACT OF 2008 (H.R. 1424)

Geothermal tax credits are also available for home owners who install geothermal heating and cooling systems through the Energy Improvement and Extension Act of 2008 (H.R. 1424). H.R. 1424 offers a onetime tax credit of 30% of the total investment for homeowners who install residential ground loop or ground water geothermal heat pumps that meet or exceed Energy Star requirements and are installed after December 31, 2007. The tax credit is available through December 31, 2016. Consult your local tax professional for advice on taking advantage of this tax credit.

HOW DO I APPLY FOR A TAX CREDIT?

For qualified HVAC improvements, homeowners may be able to claim 25C tax credits equal to 10 percent of the installed costs (up to $500 maximum*). The extended tax credit is in effect for all qualifying systems and products installed during the 2012 through 2016 calendar years and expires on December 31,2016. For qualified geothermal improvements, homeowners may be able to claim HR 1424 tax credits equal to 30% of the total installed cost. Subject to IRS regulations, tax credits apply as a direct reduction of taxes owed. The IRS has directed taxpayers to use Form 5695 to calculate and file for their residential energy credits. Customers should consult with a tax professional to fully understand how the tax credits may apply to you, what you can do to obtain one, and for advice on tax preparation.

HOW DO I LEARN MORE ABOUT AMERICAN STANDARD’S ENERGY EFFICIENT SOLUTIONS?

American Standard is committed to meeting the needs of homeowners in a very dynamic environment and offers many products under this new law. Depending on the type of system or product purchased, it may be possible to qualify for a 25C tax credit of up to $500* on your income tax return. IRS form 5695 will need to be filed with your return. To find a dealer near you, click here.

*Maximum 25C tax credit amount is $500 and is available for respective products in the following amounts: $300 maximum for a qualifying.air conditioning system, heat pump or packaged system, $150 maximum for a qualifying furnace, and $50 maximum for a qualifying product with an advanced circulating fan. The tax credit is effective for all qualified systems installed from 1/1/2012 through 12/31/2016, and is only valid to taxpayers that own their home and use it as their principal residence.

American Standard Fully Modulating AccuComfort System

American Standard Fully Modulating AccuComfort System

The American Standard Platinum Fully Modulating AccuComfort System is the most comfortable system that money can buy. Not only does it make the climate in your house precisely as you want, it is also the most efficient HVAC system Ingersoll Rand has made to date. From American Standard’s early beginnings, to purchasing Trane in 1984, American Standard has always been a trend setter. Of course, there are lots of reason why our product is the best. Let us mention a few:

- One of the main resources customers have used to determine “What to Buy” since 1936, Consumer Reports, almost always lists American Standard as the #1 HVAC product to buy, with Trane following usually just behind us. We like to think it is because the American Standard group of dealers adds just a little bit more pizzazz to our installs.

- All of our Air Conditioners and Heat Pumps have several features that are not available on ANY other manufacturers products, such as Spine Fin, easy access service panels, and Duration Compressors

- AccuComfort systems can be zoned and fully modulated to give you the exact amount of air, heat, and cooling you need for 100% comfort!

- 10 Year Parts Warranties on all parts, and excellent craftsmanship combine for peace of mind, when these systems are installed; oops, these compressors actually get a 12 Year Warranty

- Our units have remarkable defrost systems that make sure our heat pumps don’t become blocks of ice, like the other popular brands made in Indy, that are moving to Mexico

- The AccuComfort System uses a durable weather resistant powder paint, they even paint the screws, you ask why do we mention it, instead, ask us to show you pictures of the other brands

- These Heat Pumps provide 80% of their capacity down to outdoor temperatures of 17 degrees. This is excellent considering most Heat Pumps usually stop producing efficiently at temperatures just under 30 degrees

- Our Platinum Furnaces meet the requirements needed for the IRS Tax Credit, have long lasting ignitors, the longest lasting control boards, durable heat exchangers, and the best variable speed ECM motors in the industry

- Nexia thermostats control our AccuComfort systems, which are cutting edge in technology with WiFi capabilities, Diagnostics, Color Screens, and Logging abilities

Don’t hesitate to ask us to come out for a no pressure quote on the Best System in the Industry

Rob